What are Incoterms?

Incoterms (International Commercial Terms) are a set of 11 internationally-recognized rules that define the responsibilities of sellers and buyers in international trade. First published in 1936, Incoterms were created to prevent disputes between sellers and buyers trading between countries. As international trade evolved, so did shipping modes, import/export regulations, and technology. Incoterms are updated to reflect these changes. Incoterms 2020, released on January 1, 2020, is the latest edition.

The following provides an overview of Incoterms, the benefits of using them, and the changes made in the 2020 edition.

Incoterms® are copyright of the International Chamber of Commerce (ICC) and we highly recommend visiting ICC’s website to order the official Incoterms 2020 rules

What are the Benefits of Using Incoterms?

When shipping products or equipment internationally there are many activities and costs along the way that either the seller or the buyer are responsible for. Unless specified in a contract of sale, the points at which each party is liable may be unclear or open for misinterpretation.

Incoterms clearly identifies the points at which liability for transportation, risk, and cost transfers from the seller to the buyer

For example, you are a Canadian business purchasing products or equipment from company in Europe. You agree on a purchase price and payment terms. But when negotiating your sales contract, did you determine who is responsible for:

- Arranging the transportation of the products from Europe to Canada?

- Submitting documents for export clearance and paying the associated fees?

- Loading the goods onto the cargo ship?

- Arranging and paying for cargo insurance on your shipment?

- Customs clearance for the import of the products into Canada?

- Delivery of your products to your warehouse or project site?

Each of these points in the shipping journey have associated costs and risks. By incorporating Incoterms into your sales contracts, you answer these questions and each party understands their responsibilities. Including Incoterms in your sales contracts provides many benefits:

- Better planning for both buyer and seller

- Faster delivery of the goods to the buyer and payment to the seller

- A healthy business relationship between the buyer and seller

- Avoidance of disputes and misunderstandings (and the potential for increased costs)

What Incoterms are NOT

It’s important to understand that Incoterms are not law – they are a set of standards that are globally recognized and accepted by the international trade community. Accordingly:

- Incoterms do not apply to the contract of carriage with the carrier.

- Incoterms are not a contract of sale and, therefore, do not establish the terms of a contract of sale, such as:

- Description of Goods

- Transfer of Ownership

- Price Payable

- Method of Payment

- Liability

- Remedies for Dispute Resolution

- Breach of Contract

Note: While not law, Incoterms become legally binding when incorporated into a commercial sales contract.

How Incoterms Work

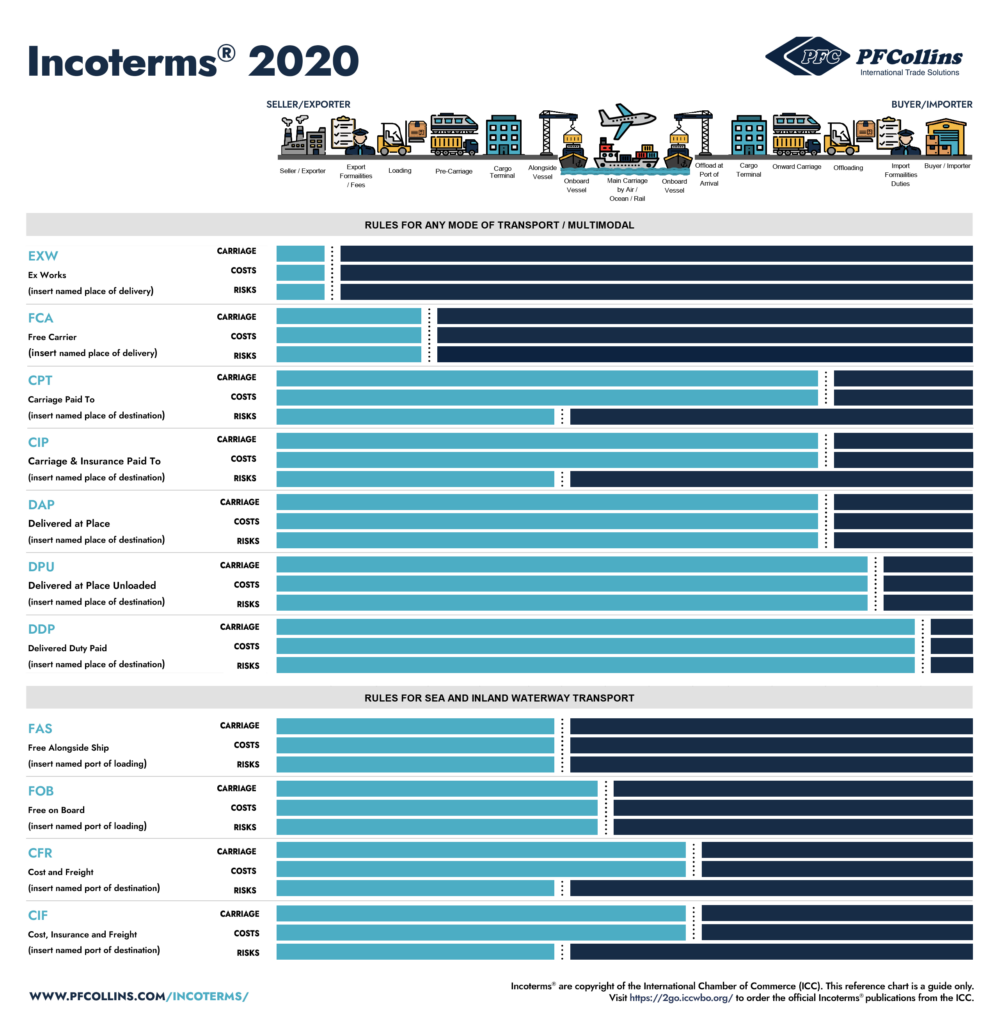

Incoterms 2020 includes 11 terms divided into two groups according to method of transport:

- Seven terms are applicable to Any Mode of Transport/Multimodal (e.g. containerized goods)

- Four terms are applicable to Sea and Inland Waterway Transport (e.g. bulk/non-containerized goods)

Each Incoterms rule indicates each party’s responsibilities and point at which risk transfers from the seller to the buyer.

The term selected should be appropriate for the goods and method of transportation and should clearly state whether the parties want to include additional responsibilities (e.g. arranging insurance coverage).

To incorporate Incoterms into your contract of sale:

- Choose the appropriate rule

- Specify your place or port of delivery as specific as possible

- Specify the version of Incoterms you are using

For example:

Note: You may still use previous versions of Incoterms (e.g. 2010). However, you should always indicate the version you are using to avoid uncertainty. Remember! Incoterms do not define every aspect of the transaction. Any other instructions that modify or clarify the terms can be written into the contract of sale.

Let us help you select the best Incoterms for your shipments

Overview of the 11 Incoterms

Click to Enlarge 🔎

Rules for Any Mode of Transport/Multimodal

1. Ex Works (EXW)

Ex Works provides the absolute minimum obligation and risk to the seller and the highest to the buyer. The buyer bears all risks and costs as soon as he collects the goods at the seller’s location. The seller must only make the goods available to the buyer (the seller does not even have to load the goods onto the buyer’s truck!).

2. Free Carrier (FCA)

Under FCA, the buyer arranges and pays for transport and the seller delivers the goods (export-cleared) to the buyer’s chosen carrier. The seller’s responsibilities end when either of the following occur:

- When the goods are loaded onto the buyer’s truck at the seller’s premises; or

- When they are placed at the buyer’s disposal (unloaded) at a cargo terminal named by the buyer.

The buyer then assumes all risks and costs associated with the delivery of the goods to destination.

3. Carriage Paid To (CPT)

The seller is responsible for export clearance and arranging pre-carriage and international transportation to the named place of destination. However, they are not responsible for insurance on the goods. Under CPT there are two critical transfer points:

- The point where the seller arranges and pays for carriage

- The point where risk transfers from the seller to the buyer

In addition to the onward transport and customs clearance at destination, the buyer is responsible for insurance and bears all risk once the goods have been handed to the international carrier at the port of origin.

4. Carriage and Insurance Paid To (CIP)

Similar to CPT, the seller is responsible for export clearance and arranging transport to the named place of destination. The buyer still bears all risk once the goods have been handed over to the international carrier, however the seller is now responsible for insurance coverage.

5. Delivered at Place (DAP)

Under DAP, the seller arranges and bears all the costs and risks associated with export clearance and delivering the goods to the named place of destination ready for unloading. The buyer is responsible for customs clearance and offloading.

6. Delivered at Place Unloaded (DPU)

A new Incoterms 2020 rule, DAP replaces Delivered at Terminal (DAT) to recognize that delivery of goods may take place somewhere other than a cargo terminal. The seller is responsible for all transport, risk, and cost and unloading the goods at the destination with the exception of import clearance.

7. Delivered Duty Paid (DDP)

This term exposes the seller to the highest risk and costs and is the absolute lowest obligation and risk for the buyer. The seller is responsible for transport, risk, and costs and unloading the goods at the destination. It is also the only term in which the seller arranges for customs clearance and pays import duties.

Note: The DDP term does not cover Goods and Services Tax (GST). A separate clause on the invoice should indicate the party responsible for payment of GST.

DDP sounds appealing for the buyer, however, they have little control of the type of transport selected, delays, and duties/taxes, contributing to additional transport or duty/tax costs.

Rules for Sea and Inland Waterway Transport

1. Free Alongside Ship (FAS)

The seller clears the goods for export and delivers the goods when they are placed alongside the cargo ship selected by the buyer at the named port of loading. The buyer is then responsible for loading the goods onto the ship and all transport, costs, and risks from that point forward.

2. Free on Board (FOB)

The seller is responsible for clearing the goods for export, delivering them to the port of shipment, and loading them on board the ship. Once the goods are on board, costs and risks transfer to the buyer.

3. Cost and Freight (CFR)

The seller clears the goods for export and delivers the goods when they are onboard the ship. They are responsible for the costs of transport to the named port of destination. However, the buyer is responsible for the goods as soon as they are loaded onto the ship at the port of origin.

4. Cost, Insurance and Freight (CFR)

Similar to CFR, except now the seller must also arrange and pay for minimum insurance coverage. They clear the goods for export and deliver the goods when they are onboard the ship. They are responsible for the costs of export clearance, transport, and insurance coverage to the named port of destination. The buyer is responsible for the goods when they are loaded onto the ship at the port of origin.

Changes Introduced in Incoterms 2020

DAT Changed to DPU

Delivered at Terminal (DAT) has changed to Delivered at Place Unloaded (DPU). This is to take into consideration that delivery of goods may take place somewhere other than a cargo terminal.

FCA On-Board Bill of Lading

One of the biggest drawbacks of the FCA term has been the seller’s inability to obtain a bill of lading with on-board notation to satisfy banking requirements under a Letter of Credit.

Under FCA, the seller completes delivery when they load the goods onto the buyer’s transport for pre-carriage. As the seller does not load the goods onto the international carrier, the carrier does not have to provide proof of loading to the seller.

Incoterms 2020 allows the buyer to instruct the international carrier to issue the on-board notation to the seller. The seller then forwards the Bill of Lading to the buyer so that they do not take on the responsibility of the contract of carriage with the carrier.

Increased Insurance Coverage

Incoterms 2020 requires the seller to obtain a higher level of insurance under the CIP term. Previously, the seller only had to provide minimum insurance coverage. Now they must purchase total (all risk) coverage. However, the seller and buyer may negotiate higher or lower levels of coverage.

CIP applies to multimodal transport (e.g., containerized, manufactured goods). Therefore, this change provides flexibility in insurance for different product types and transportation modes.

Consideration for Use of Own Transport

Previous versions of Incoterms assumed the seller or buyer would be hiring a third party for transport. Incoterms 2020 allows sellers and buyers using their own trucks under the Contract of Carriage.

Increased Emphasis on Security

Incoterms 2020 puts greater emphasis on responsibilities and costs associated with security.

We’re Here to Help!

Incoterms are complex and often applied incorrectly, costing the buyer or seller time and money. We can assist in selecting the appropriate terms for your contracts and answer any questions you may have about Incoterms or international shipping

The Incoterms® Rules are protected by copyright owned by ICC. Further information on the Incoterm rules may be obtained from the ICC website. Incoterms® and the Incoterms® 2020 logo are trademarks of ICC. Use of these trademarks does not imply association with, approval of or sponsorship by ICC unless specifically stated above.